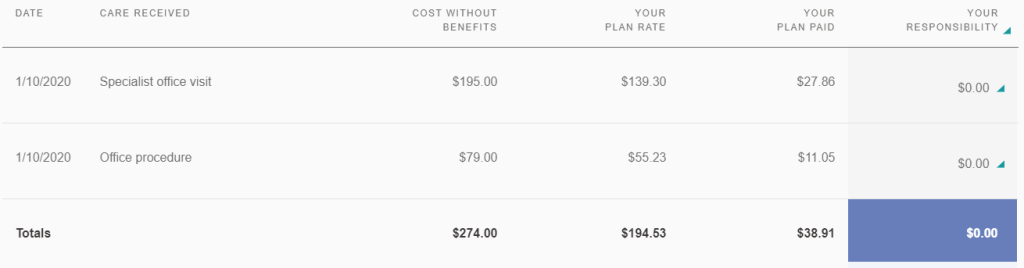

The fun starts now! Back on January 10th, I went to see a podiatrist for a check up since I’m diabetic and have peripheral neuropathy. Since the podiatrist was a specialist, I paid my $40 co-pay and thought everything was fine. Well, the podiatrist office finally filed the insurance claim, and I got the following statement of benefit from my work insurance.

The podiatrist office billed $274.00 for my visit but the negotiated rate for Blue Shield is $194.53. My insurance then determined that since I have Medicare starting 1/1/2020, they are the primary insurance, and should cover 80% or $155.62. Therefore, my work insurance only needs to cover the remaining 20% or $38.91. On my call with my work insurance yesterday, they said I need to give all my providers a copy of my Medicare card so they can bill Medicare. For this claim, I should get my $40 back once Medicare pays. I had a lot of doctor appointments in January. Since none of the claims have been processed, I will need to do this with 5-6 providers and lots of claims.

I see some potential problems with this. First, once I pay my co-pay, it’s very hard to get that money back. I have to follow up on each claim to see if and how much Medicare pays, and harass the doctor’s office for refund. Also, who determines which insurance is primary? What if Medicare decides they are secondary and my work insurance should pay 85% first? Also, for the claim above, the plan rate was less than what the podiatrist billed. What is the Medicare plan rate? I think it’s often less than private insurance reimbursement rate. So what if Medicare’s rate is only $100 and they pay 80% or $80? What happens then? What if the medical provider does not accept Medicare in the first place? Sometimes I think having a single health insurance payer, like they do in Canada, is much easier on the consumer. Doctors and hospitals will probably lose out though since reimbursement rates will definitely be lower.

One thought on “Insurance Coordination of Benefits”