I saw an Instagram reel where someone buys a pair of Nike sneakers for $15,000. This was not the only video as there is a large speculative secondary market for sneakers. I guess some of the buyers are collectors, but many are buying to resell at a premium. We learned about this in business school, with the classic example being Dutch tulip bulbs.

The Dutch tulip bulb market bubble, also known as ‘tulipmania’ was one of the most famous market bubbles and crashes of all time. It occurred in Holland during the early to mid-1600s when speculation drove the value of tulip bulbs to extremes. At the height of the market, the rarest tulip bulbs traded for as much as six times the average person’s annual salary.

Today, the tulipmania serves as a parable for the pitfalls that excessive greed and speculation can lead to.

https://www.investopedia.com/terms/d/dutch_tulip_bulb_market_bubble.asp

Of course, there are many examples of bubbles. People say that there is a housing bubble in Southern California. My run-of-the-mill four-bedroom house built in 1987 has an Internet valuation of ~$1.3M. Is that a fair price? Houses nearby are being sold at similar prices so maybe? Will the bubble burst at some point and send prices crashing? Likely. However, there is an intrinsic value to a house as a shelter so there is a floor to the valuation. Same thing for stock. There have been bubbles too, but there is an intrinsic value to well-established and well-managed companies. Stock in large blue chip companies will go up and down, but are unlikely to drop completely to zero.

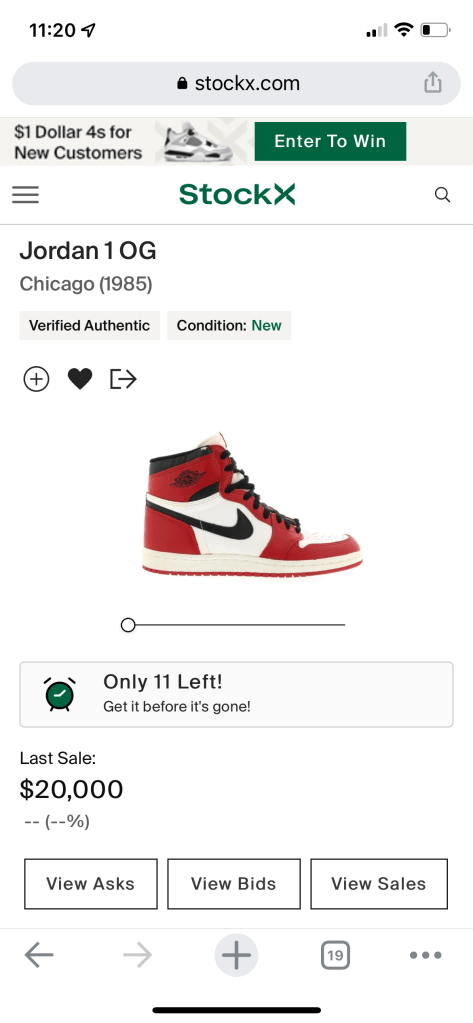

What about sneakers? How much are people willing to pay for a (nice) pair of shoes if the collector market crashes? $50? $100? My friend is into collecting basketball cards. He would go to Target on restock days to see if he can get a box of cards cheap, but there are usually a crowd of people doing the same. IMHO, some of these cards have ridiculous valuations, like hundreds of thousands of dollars for a Jordan rookie card or something. Ultimately, it is a small piece of cardboard. The intrinsic value is near $0, and any valuation is due to the artificial scarcity created by the card companies. I have no issues with people speculating, but all market bubbles will burst, and there will be lots of people left holding worthless “investment” items.

==========

I found a listing for a pair of 1985 Air Jordans in Chicago Bulls colors. My sister had these exact same shoes, and in 1987, she got them signed by Reggie Miller and Pooh Richardson while they were still seniors at UCLA. Imagine what they would be worth now if she kept them pristine in the box.