I lived with my parents for the past ten plus years until they purchased their own house earlier this year. Since they have always handled cooking and food costs, I am not as aware of the impact of the recent high inflation rates groceries. I mainly paid for costs related to the house, such as property taxes and utilities, which are less susceptible to inflation.

On Friday, I stopped by the local Raising Canes to get a Box Combo. I was surprised at the cost, which was $12.66 including tax. This was much higher than what I remembered. Since I always pay with the same credit card, I could search for older transactions online and found these data points:

| Date | Cost |

| 11/11/2020 | $12.66 |

| 8/31/2022 | $10.85 |

| 6/28/2021 | $10.19 |

| 4/28/2021 | $9.82 |

| 1/26/2021 | $9.52 |

The last date is interesting as it is the day before my kidney transplant. It was probably not the best food choice right before major surgery.

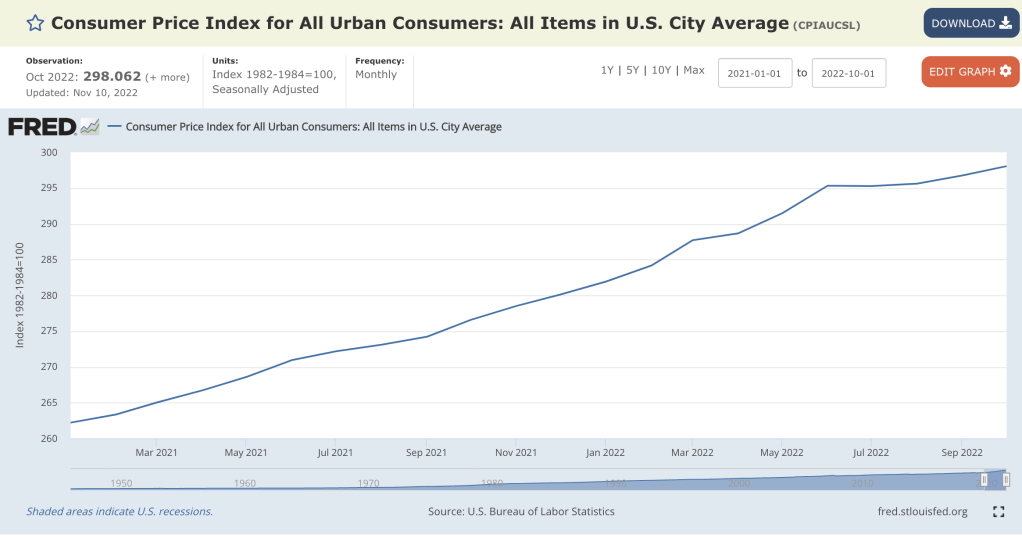

If we take the first and last dates and call it 21 months, the inflation rate is (12.66 – 9.52)/9.52*(12/ 21) or about 18.8% per year. Now if we look at actual inflation, it is nowhere near that high. Here is a chart for Consumer Price Index (CPI) for urban consumers over the same period:

If the numbers are too small, the index starts at 262.200 and ends at 298.062. That works out to about 7.8% per year. So, we can probably say that Raising Canes Box Combo’s price is increasing at 2.4x inflation during the past two years. That sucks.

Of course, it is just not chicken. My sister, my younger niece, and me went to get ramen last night. We got three bowls of ramen, an order of California rolls, and some edamame appetizers. The total with tax was about $70 or $85 with a 20% tip. That seems absurdly expensive for mediocre ramen. Let us hope that with dropping gas prices, inflation will be lower in the future.