When I quit my job last year, I elected to receive COBRA coverage instead of looking for my own health insurance. Due to federal law, I was eligible for eighteen (18) months of coverage. The cost was from $650 to $700 per month for health, dental, and vision insurance. Other than changes in the mail order pharmacy provider, there were no significant changes in coverage.

After eighteen months, there is a California law that provides an additional eighteen months of COBRA coverage, called Cal-COBRA. I checked with the benefits team at my old employer regarding my eligibility and was told that I would not be covered since the company was considered self-insured. I am familiar with this part since I was the company treasurer, and I paid the $million insurance bill every month.

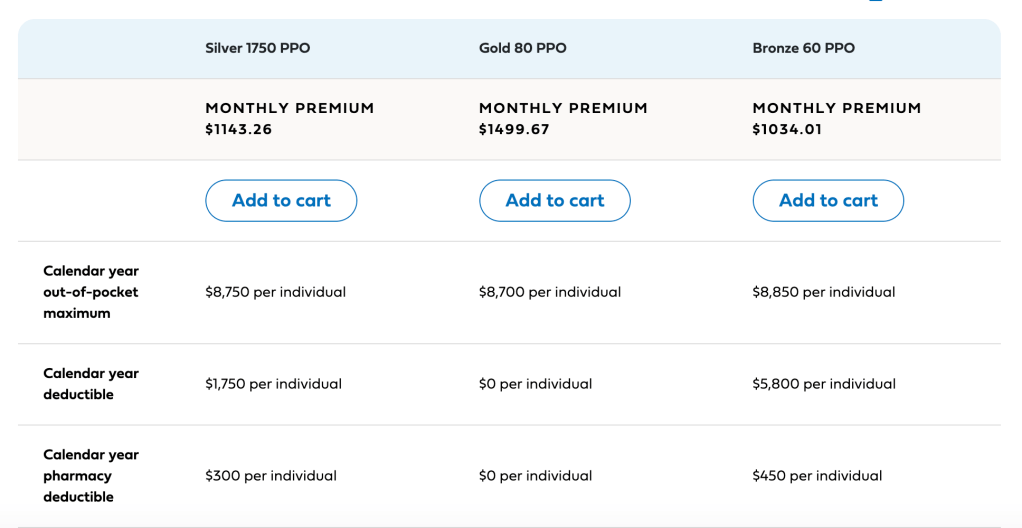

Like everything in this world, it is not a problem if it can be solved with money. If I am no longer eligible for COBRA coverage, I can simply go online and buy my insurance. I was told in the past that our company’s coverage is equivalent to a high silver plan. Since we used the Blue Shield of California network, that is where I looked first.

The first thing you notice is the very high primium cost for any plan. Looking through my current coverage, it appears to be better than the Gold 80 PPO plan shown above. There is a Platinum level plan, but the cost is over $2,000 per month. For just one person.

For now, I will need to verify the answer given to me by the benefits analyst. Her first email said I was eligible for Cal-COBRA, but a subsequent email five minutes later said otherwise. I want to stay with Blue Shield for ease of transition, but I should also check the healthcare exchange to see if there is a better deal.