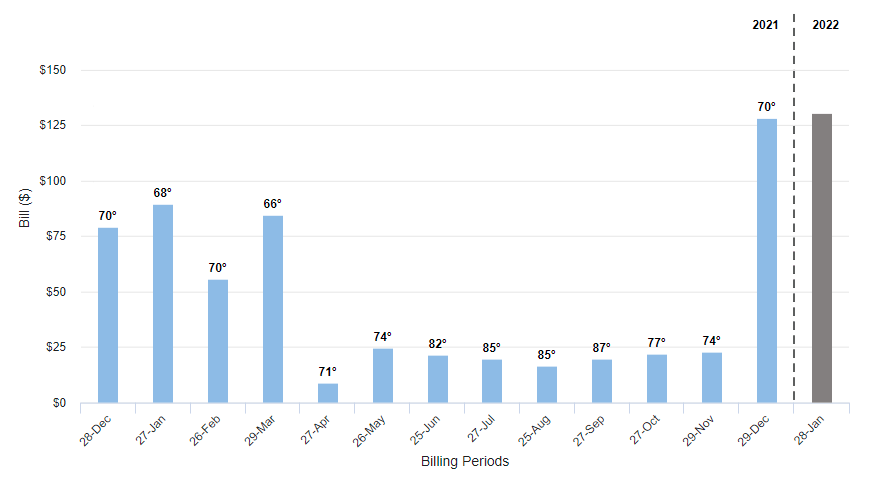

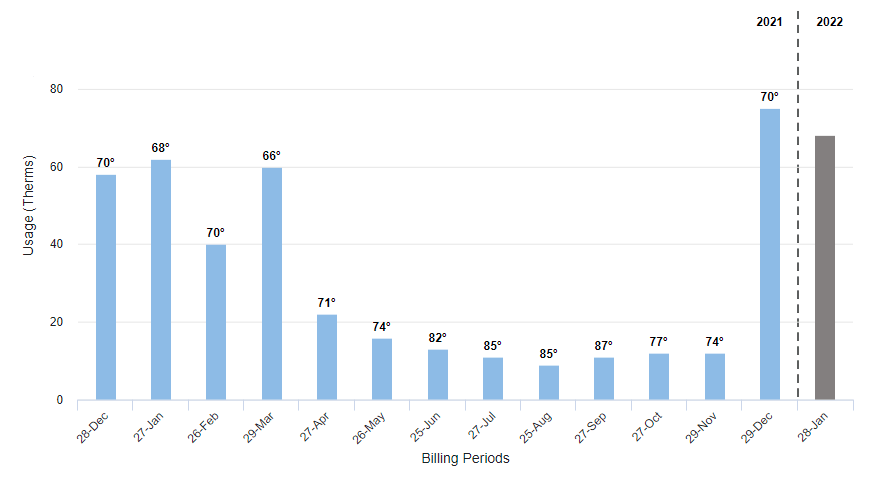

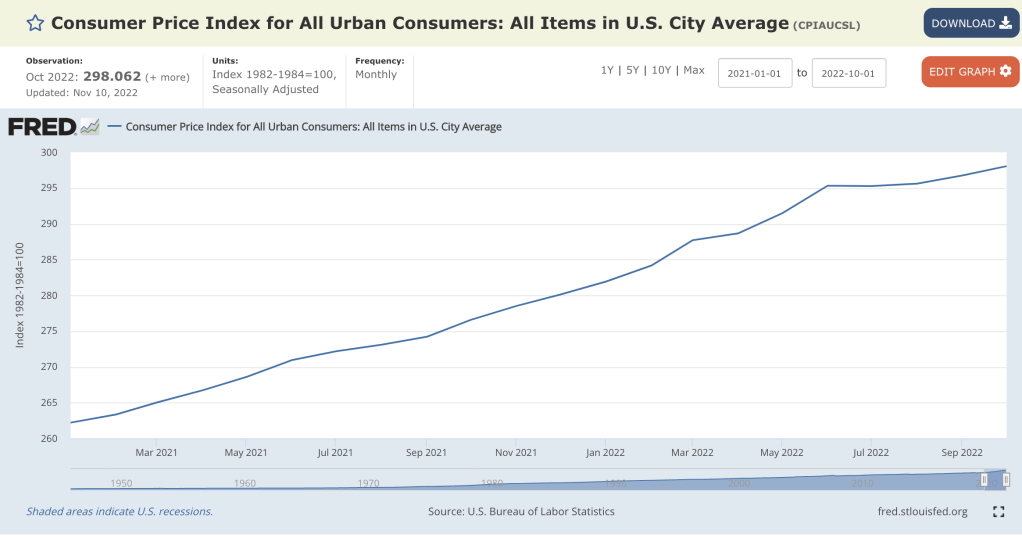

I paid $60 last week for a Paramedics Membership with the City of Orange. When I first moved here in 2009, there was no additional charge for paramedic services. Then suddenly one year, the option to include $2 per month was included in our water/sewer bill to opt-in. That then became a $48 one-time fee payable only by check, and now it is $60.

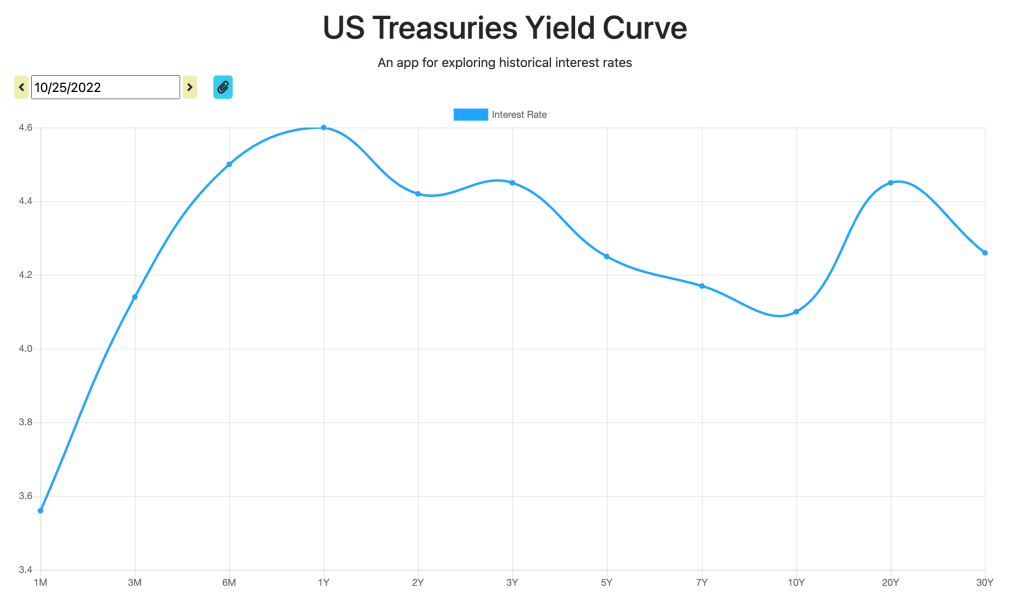

This is basically insurance for paramedic calls. It covers all services for everyone in your household (up to ten people) anywhere in Orange and covers visitors to your house. My problem with this setup is that local emergency services is a monopoly. When you call 911 for a medical emergency, the call is routed to the fire department. You cannot choose another provider. Knowing that it is a captive market, the fire department refuses to participate in any insurance networks, so they will always be out-of-network and can charge astronomical fees.

I experienced this fucked-up system twice while I was on dialysis. The first time was when I had severe hypoglycemia. I woke up in the morning delirious and my parents called 911. The paramedics game me a glucose/dextrose IV and took me to the St. Joseph hospital ER. Even though I enrolled in the program, the fire department still tried to bill me about $2,000. The billing office claimed that someone else lives at my house, so I was not covered. It took over three months to clear that up. I also got a 30-second ride from the dialysis clinic to the ER due to a likely panic attack. I remember the fire department sending a similar bill to insurance, but that was somehow paid by insurance, and I did not have to pay.

Why are paramedics not covered by my property tax? Police and remaining fire department services are included. I think it is because you can use fear to motivate residents who are old or in poor health to sign up. If they do not, then the fire department can charge thousands of dollars for services. I really want to see if they are making money on this program and what the justification is to increase the fees from $24 to $48 then $60 in just a few years.

==========

I have lived in three other cities, five if you include my immediate family, in Orange County. No other city charges separately for providing basic emergency service for residents. The City of Orange also forces you to get a business license and pay fees if you claim business expenses on your taxes. I used to incur some travel expenses when I helped my friend with his company in China. This was not an issue when I lived in Brea or Costa Mesa. However, as soon as I moved to Orange, I got a notice demanding I get a license that costs a minimum of $65 each year. The city provides absolutely zero services, but they want their pound of flesh. Fucking assholes.

:max_bytes(150000):strip_icc():format(webp)/AmazonPrimeVisa-adc39a693e70417ca1ec7ee47752a9b0.png)