I have been sleeping pretty well last few days, but for some reason, I cannot fall asleep tonight. It is 3:45 pm and I have not slept at all. Instead, I have been browsing Reddit and came across this post. It is nothing new; there is probably something about “free healthcare” posted every minute. Since Reddit users are mostly young and liberal, you can guess how these discussion usually go.

Politically, I am probably more liberal socially (for an American) and more conservative fiscally. Basically people should be able to do what they want, as long as I do not have to pay for it. Also, the post above is asking doctors for their opinion. I am not a doctor, just an experienced patient, but I feel qualified to discuss the financial impact of “universal” healthcare.

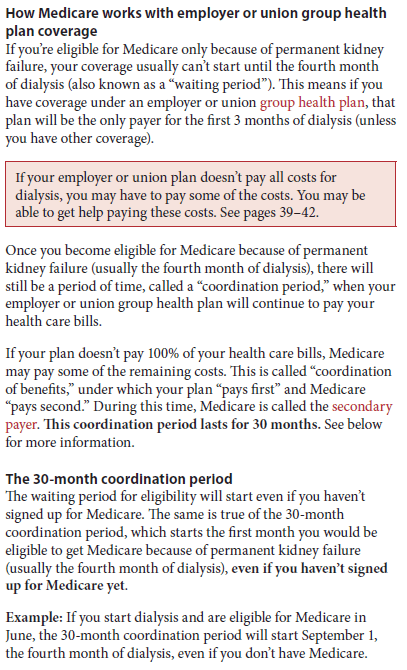

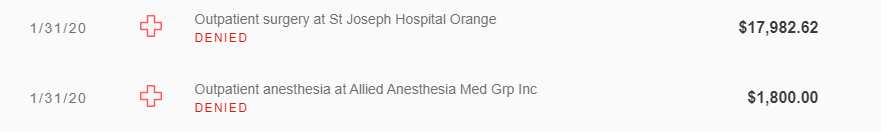

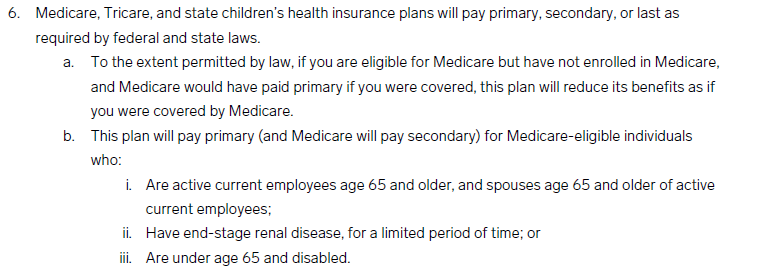

First, some data. Medicare was 14% of the US federal spending in 2019, or about $644 billion. Next, the medical insurance recorded medical costs of $632 billion and administrative costs of $88 billion. Overall, the industry only has a 3% profit margin, or about $22 billion. If we enacted “free’ healthcare, in the short-term, Medicare costs will increase by 100% or more since costs will not change much initially, but demand will likely increase. In 2019, insurance companies collected $735 billion in premiums so I guess companies/individuals can just pay that as a tax. However, since half of the population do not pay taxes, the impact of any new “healthcare” tax will impact middle and upper class Americans. Another issue is Medicare reimbursement rates are much lower than private insurance. A lot of doctors either do not take Medicare or limits the number of Medicare patients. What happens when Medicare is the universal insurance? Will doctors and hospitals agree to what essentially a huge pay cut?

Finally, as mention above, I really hate the word “free” because it is not free. In reality, it just means someone else is paying for it. Reddit comments like to say that insurance profits will save lots on medical costs. Yes, $22 billion is a lot of money, but it is tiny compared to the size of the healthcare market. The solution is probably to focus on preventive medicine and force doctors and hospitals to make less money. Will that work?

==========

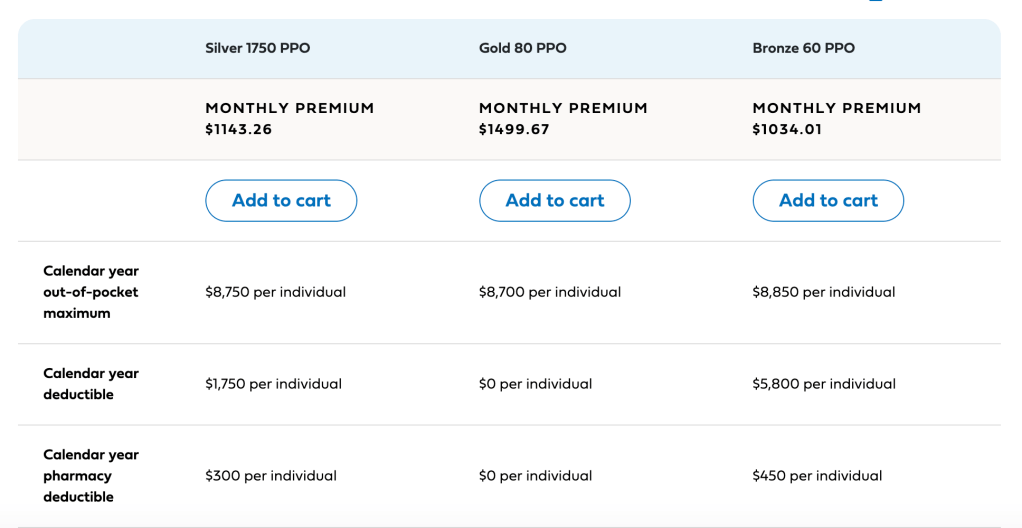

Since I am missing a lot of demographic data, I will use my company as an example. We are self-funded, which means the company pays an insurance company (Blue Shield) a small fee ($40 PEPM*) to use their provider network and negotiated prices. Our costs are around $850 PEPM, and some employees pay a premium. If we use $800/month, that works out to $9,600 per employee annually. If the company pays that to the government as a corporate healthcare tax, then I am agnostic. However, I know from speaking to our insurance broker that $850 PEPM is very low, as our employee base is pretty young. Most other companies in the industry spend more. Our company switched to a self-funded model to save money, but a universal healthcare tax may just spread costs based on averages and we would pay more. Even worse, if our company just gave everyone $10k to cover the new healthcare tax, I am pretty sure my tax increase will be a lot more than the $10k since I am in the group that pays taxes.

Sigh. I see the benefit of universal healthcare. People do not have to worry about going bankrupt from medical bills, and it will probably increase the health of poorer Americans. However, if we cannot control costs, then we could have worse health outcomes and a damaged economy. I have a lot of relatives in Canada. They pay a lot more taxes for their “free” healthcare, and while it seems like a better system for small health problems, it is absolutely terrible for serious illnesses.

*PEPM = per employee per month.