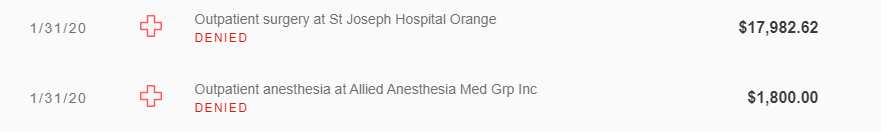

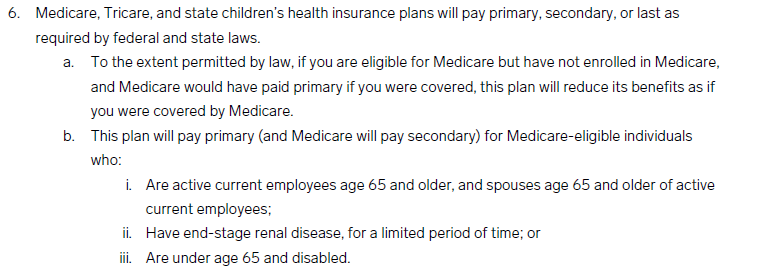

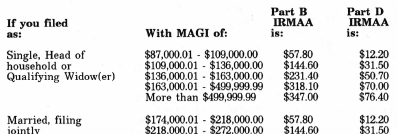

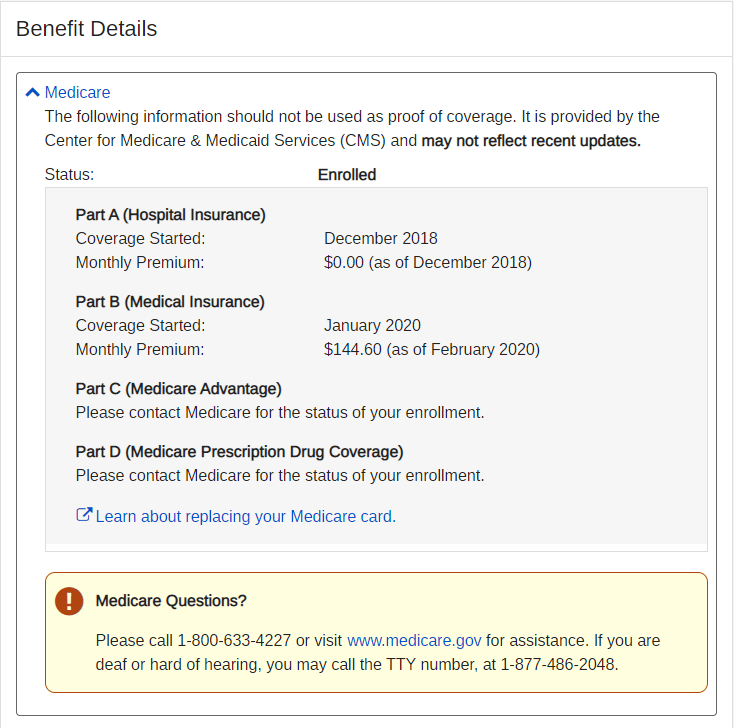

So, my Medicare coverage ended yesterday. I was eligible for Medicare due to ESRD while I was on dialysis. This carried over when I received a kidney transplant three years ago. The rule says that kidney transplant patients can keep Medicare for three years post-transplant. Since I was still working and making salary, I was in the highest Medicare premium tier and my monthly payment was around $600. Going forward, I will only have my work insurance, then COBRA when I finally retire in a few months.

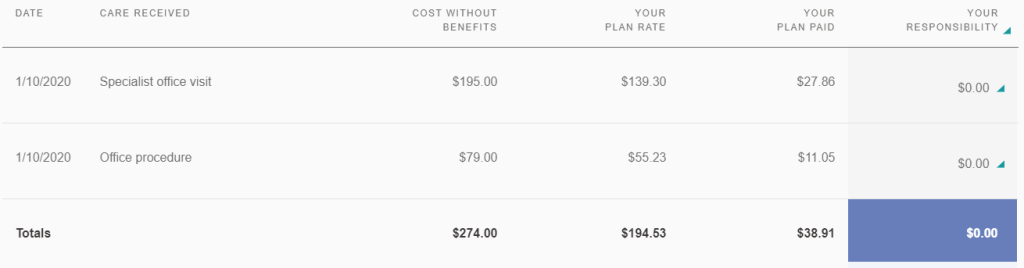

I am not sure if Medicare was worth it after transplant. With two insurances, I did not have to pay anything for medical services since Medicare covered 80%, and my work insurance covered the rest. Now I will be subject to deductibles and co-pays but save on Medicare premiums. I also have the option to continue Medicare coverage just on my anti-rejection medication, but since no one accepts Medicare Part A for drugs, I will probably rely on my work insurance for prescriptions and deal with everything together when COBRA runs out.

==========

The Social Security Administration did send me a letter last month reminding me that my Medicare coverage ends on January 31, 2024. I am 50/50 on whether they stop debiting my bank account for premiums at the same time.